A Saudi Arabian wealth fund revealed in a SEC filing how they’ve been pursuing the purchase of U.S. investments. The Securities and Exchange Commission showed how Saudi Arabia’s Pubic Investment Fund recently purchased more than 5 million shares of stock in the Walt Disney Company for under $500 million.

To put it in perspective, even though it’s a substantial dollar amount, the 5 million shares are less than a fraction of a percent of the company’s total shares. The wealth fund has lately been seeking investments in U.S. sports and entertainment companies. According to a SEC filing, the investment entity recently bought more than 12.3 million shares of Live Nation’s stock, which now gives them a 5.7% stake in the entertainment company.

The Public Investment Fund (PIF) also bought shares in several other major companies. For instance, they bought shares of Berkshire Hathaway, Starbucks, Back of America, and Facebook. The PIF controls more than $300 billion in assets and is led by Crown Prince Mohammed bin Salman. Today, the fund’s portfolio totals more than $10 billion in U.S. holdings.

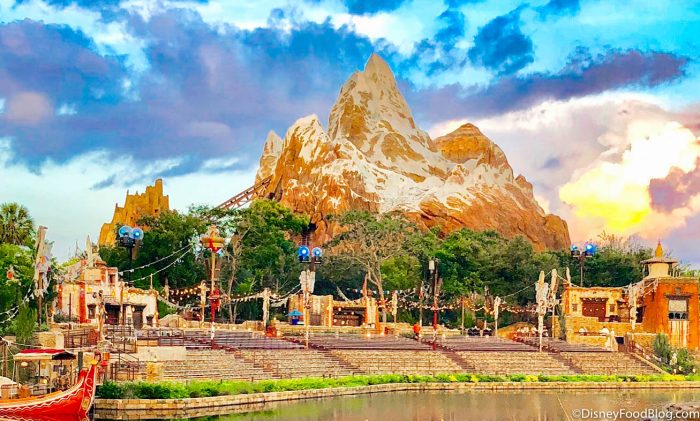

Due to the COVID-19 pandemic, companies such as Disney have been accumulating debt since they were unable to operate their routine business functions. From a debt perspective, acquiring new investors helps them leverage the debt with new equity.

Source: The Wrap

From our friends at chipandco.com